At the start of every year, it’s important that businesses take stock of developments in the 12 months prior that may require adjustments to their insurance policies.

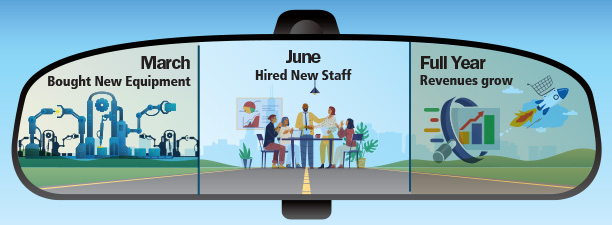

A number of events like purchasing new equipment or expanding to new territories should prompt you to meet with us to see if you should increase your coverage. It’s important you conduct this annual review to ensure that you are fully covered and that your claims will be paid if you have an incident.

Annual reviews will also identify if your business changes warrant any new types of insurance, such as cyber coverage, professional liability or commercial auto.

Events requiring policy changes include:

Inflation — Property rebuilding and construction costs have been skyrocketing, meaning that if your facilities sustain damage from a covered event, your policy may not be sufficient to cover all rebuilding costs.

Construction costs are increasing due to the labor shortage in the industry, the rapid price increase for all types of building materials and supply chain constraints that have reduced the availability of some products.

Hiring new staff — You should contact your agent or workers’ compensation carrier if you are expanding and hiring more staff.

If you haven’t reported higher employee numbers to your carrier in the past year, you should. If you don’t, the insurer will catch them during your annual policy review or a policy audit and you could be on the hook for back premiums.

Buying new equipment or upgraded facilities — If you purchased new equipment, and if you renew your business property without adding coverage for it, claims related to that equipment might not be covered.

Also, if you’ve upgraded your property, built a new wing or revamped the interior, you may also want to revisit your property policy.

Change in operations — If your operations have changed, such as adding a new product or service, you may need to make changes to your insurance policies. Having more products or services means you likely have new equipment or inventory you need covered.

On the other hand, if you removed any products or services, you will be able to remove them from your insurance. You may also need to adjust your limits if the risks associated with your operational changes have altered.

Your revenues have changed — If your fortunes have boomed or your revenues are declining, your insurance policies may need to change as well to reflect that.

Also, if there has been a change in ownership, your business or business structure (changing from partnership to an LLC, for example), you may need to inform your insurer.

Other reasons

There are other reasons to review your coverage annually, chief among them that you may be missing out on savings. You may also be paying more for your coverage if you are not taking into account factors like retiring, not replacing a vehicle or reducing your staff count.

By reviewing your current business circumstances, you can help us and your carrier accurately price your policy.

Some of your policies may also be eligible for discounts and we can help you tap into any that may be available to you.

There are also instances where you would need to get a new policy altogether, such as transitioning from a sole proprietorship to a partnership or an LLC, or if you have merged with another entity.

If you’ve expanded into new territories, either physical with a new location, or if you expanded your service area, you may also need a new policy, particularly if you are going into a new state.

The takeaway

By reviewing your policies every year, you can ensure that you are properly covered in case you have to file a claim. The last thing you want is to file a claim for property you forgot to include on your policy application and your insurer rejects your damage claim.

Finally, you may also want to consider your plans for the upcoming year so that you can be prepared to update your policies when any major milestones like any of the above might take place.